What Does CVV Means On ATM Card? It is said that there is no place for secrets between friends and family. However, this does not apply to your debit card. It can be difficult, but there are good reasons why your card details should be kept secret.

Details printed on a debit or credit card include the cardholder’s full name, card number, date of issue, and expiration date. These details are the first level of security and should not be shared with anyone.

However, the most important number on your card is the CVV. So, What Does CVV Means On ATM Card? The CVV must be kept secret to protect your card against unauthorized use. So even if your debit card is likely hidden in your wallet while you’re inside today, the CVV can still be used when you transact online. Ever wondered What Does CVV Means On ATM Card? Read on for more information about the CVV.

Table of Contents

What Does CVV Means On ATM Card?

CVV stands for Card Verification Value. This number is essential for completing online transactions and should never be shared with anyone. The CVV number is generated by payment card issuers (banks or other financial institutions) based on the following data:

- DEBIT CARD NUMBER

- SERVICE CODE

- CARD EXPIRY DATE

- UNIQUE PUBLISHER CODE

CVV numbers are also known as CSC (“Card Security Code”) numbers, as are CVV2 numbers, which are the same as CVV numbers, except they are generated through a second-generation process that makes them harder to “guess” to be.

Parts in a CVV

The CVV number consists of two parts.

- The first part is covered with a scratched magnetic stripe. It contains crucial unique data about your debit card. This information is retrieved when the card is passed through a magnetic reading machine.

- The second part consists of numbers that must be entered in an online or telephone transaction. This security number is one of the many advantages of a debit card.

What is the CVV number for?

All financial institutions that issue credit or debit cards have developed a system in which each card is given a unique CVV code. This code is required to complete any cash transaction with the card. The CVV number is different from the PIN, which is similar to a password to complete card transactions. The CVV number is printed on the magnetic stripe on the back of your card. Verifies that the card is physically available to the person using it during the transaction.

CVV protects you against fraud

Debit and credit cards are mainly used for online transactions or other virtual payment gateways. These portals cannot store information about the cardholder’s CVV number, as this violates the data security standards of the payment card industry. So even if the provider has all your other card details, you will not have access to the CVV. This makes it impossible for anyone to misuse your card details. So if there is a breach of the credit card company’s data security, the CVV will not be stored in the databases. This makes it impossible to use your credit card for transactions without the CVV.

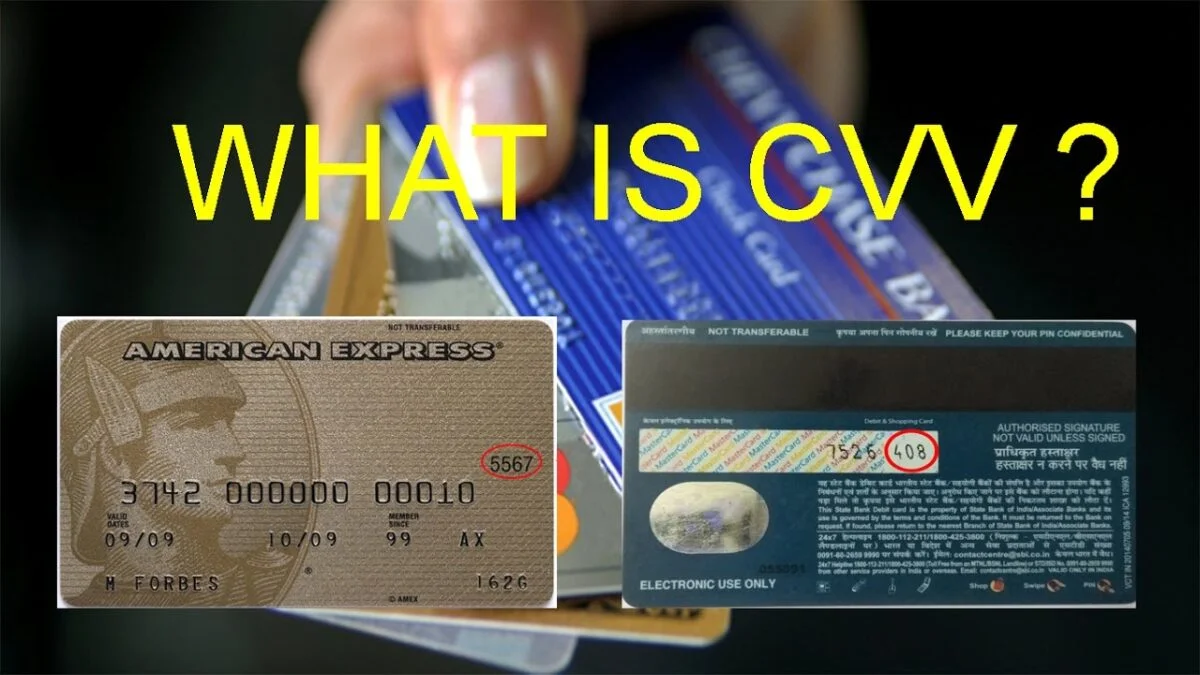

How do I find the CVV on a debit card?

Finding the CVV is easy. It’s the three-digit number on the back of your debit card. For certain types of debit cards, it may be a four-digit number printed on the front.

Is the CVV the same as my card’s PIN?

Your card’s identification number (PIN) is NOT the same as the CVV. The PIN is used to make face-to-face transactions with the card or at ATMs. While the CVV is used in online or telephone payments.

What happens if I swipe my card?

Fortunately, unlike other details on a card, the CVV cannot be saved while swiping or punching online. While the CVV offers security, it does not relieve users of the precautions they must take when using a debit card, such as not sharing the CVV with others.

Does CVV have drawbacks?

The only downside is that if the credit card is fully duplicated with the magnetic stripe and the scammer also has access to your CVV code, the card can be easily misused.

Conclusion – What Does CVV Means On ATM Card

We hope this article has been informative about the nuances of a debit card. You can apply for a debit card that is packed with benefits as it earns up to 7% interest per year. on your savings account!

Now that you know the role CVV plays in credit cards, you can also share this information with others to prevent people from being part of scams.