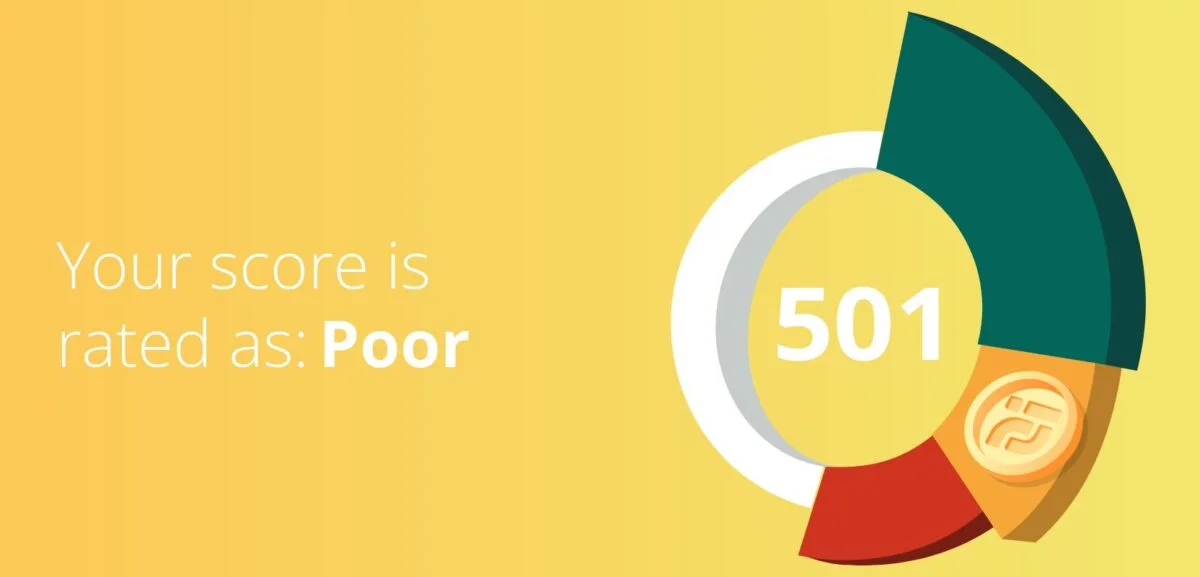

Is 501 a Bad Credit Score? Yes, if your score falls within the range of scores, from 300 to 579, which are considered very bad. A FICO® Score 501 is significantly below the average credit score.

Many lenders choose not to do business with borrowers whose score falls in the Very Poor range, due to poor creditworthiness. Credit card applicants with scores in this range may be required to pay additional fees or deposit funds into their cards. Utilities may also ask you to make deposits on equipment or service contracts.

16% of all consumers have credit scores in the very poor range (300-579).

About 62% of consumers with a credit score of less than 579 are likely to become serious delinquents in the future (ie more than 90 days late in debt).

Is 501 a Bad Credit Score?

Is 501 a Bad Credit Score? A credit score of 501 can be a sign of past credit problems or lack of credit history. Whether you’re looking for a personal loan, mortgage, or credit card, credit scores in this range can make it difficult to get approved for unsecured credit, which requires no collateral or security deposit.

Percentage generation with credit scores from 300-639

| Generation | Percentage |

| Gen Z | 40.9% |

| Millennial | 43.5% |

| Gen X | 40.5% |

| Baby boomer | 25.8% |

| Silent | 14.7% |

| Greatest | 27.3% |

Most credit scores range from 300 to 850, and lenders tend to view scores in the 500 to 600 range as less than ideal. Why does it matter what lenders think? Because they use credit scores to assess the risk associated with borrowing money.

With a low credit score, you may struggle to qualify for credit. You may have already been turned down for a credit card you were interested in, or you may only qualify for loans with high-interest rates and fees.

If so, don’t lose hope. Understanding what goes into your credit scores — and yes, you have more than one credit score — is key to building your credit. You may have heard that your scores are calculated based on the information in your credit reports, but what does that mean?

In this article, we’ll show you how important credit information can affect your credit scores. Credit bureaus such as Equifax, Experian, and TransUnion collect this information from lenders and financial institutions and use it to create your credit reports. The information in those reports is then processed through various credit scoring models and, voilà, your scores show up on the other side.

But that’s not the whole story. Let’s take a closer look at how to build credit so you can work on better financial products. Taking the right steps today can pay off later.

Is 501 a Bad Credit Score – How to Improve Your 501 Credit Score?

The bad news about your FICO® score of 501 is that it is well below the average credit score of 711. The good news is that there are plenty of opportunities to increase your score.

99% of consumers have a FICO® score above 501.

A smart way to build a credit score is to get your FICO® score. Along with the score itself, you get a report detailing the major events in your credit history that lower your score. Because that information is pulled directly from your credit history, it can identify issues you can address to improve your credit score.

How to overcome a very bad credit score?

FICO® scores in the Very Bad range often reflect a history of credit slips or errors, such as multiple late or missed payments, delinquent or foreclosed loans, and even bankruptcy.

Of consumers with a FICO® score of 501, 19% have a credit history indicating they were 30 or more days late on payments in the past 10 years.

Once you are familiar with your credit report, its contents, and its impact on your credit scores, you can take steps to build your credit. As your credit behavior improves, your credit scores will usually follow suit.

What Affects Your Credit Score?

While it’s helpful to know the specific behaviors in your credit history, the types of behaviors that can lower your credit score are generally known. Understanding them will help you better focus your credit scoring tactics:

Public Information –

If bankruptcies or other public records appear on your credit report, they usually have a serious impact on your credit score. Paying off liens or judgments as quickly as possible can lessen their impact, but in the event of bankruptcy, time alone can lessen their damaging effects on your credit score. A Chapter 7 bankruptcy will stay on your credit report for up to 10 years, and a Chapter 13 bankruptcy will stay there for 7 years. While your credit score may begin to recover for years before bankruptcy removes your credit file, some lenders may refuse to work with you while you have filed bankruptcy.

The average credit card debt for consumers with FICO® scores of 501 is $2,734.

Credit utilization rate.

To calculate the credit utilization rate on a credit card, divide the outstanding balance by the card’s borrowing limit and multiply by 100 to get a percentage. To calculate your total occupancy rate, add up the balances on all your credit cards and divide by the sum of your loan limits. Most experts recommend keeping usage below 30%, card by card and in general, to avoid hurting your credit score. Usage percentage contributes up to 30% to your FICO® score.

Late or missed payments.

Paying bills consistently and on time is the best thing you can do to promote a good credit score. This can represent more than a third (35%) of your FICO® score.

Length of credit history.

All things being equal, a longer credit history will lead to a higher credit score than a shorter history. The number of years you have been a credit user can affect your FICO® score by up to 15%. Newcomers to the credit market can do little about it. Patience and care to avoid bad credit behavior will improve the score over time.

Combination of credit and total debt.

Credit scores reflect your total outstanding debt and the types of credit you have. The FICO® credit scoring system favors users with multiple credit accounts and a mix of revolving credit (accounts such as credit cards, which borrow within a certain credit limit) and installment credit (loans such as mortgages and car loans, with a fixed number of fixed monthly installments). If you only have one type of credit account, expanding your portfolio can help improve your credit score. The combination of credits is responsible for up to 10% of your FICO® Score.

Recent credit activity.

Constantly applying for new loans or credit cards can hurt your credit score. Credit applications trigger events known as deep investigations, which are recorded in your credit report and reflected in your credit score. In a thorough investigation, a lender obtains your credit score (and often a credit report) to decide whether to lend to you. Tough questions can lower credit scores by a few points, but scores usually recover within a few months if you keep your accounts up to date and don’t make additional loan applications until then. (Checking your credit is a smooth request and will not affect your credit score.) New credit activity can make up to 10% of your FICO® score.

Is 501 A Bad Credit Score – Improve Your Credit Score

There are no quick fixes for a very low credit score, and the negative effects of some problems that cause very low scores, such as bankruptcy or foreclosure, only diminish over time. You can immediately start adopting habits that promote improvements in your credit score. Here are some good starting points:

Consider a debt management plan.

If you are overwhelmed and having trouble paying your bills, a debt management plan can provide some relief. You work with a not-for-profit credit consulting firm to negotiate a workable payment schedule and effectively close your credit card accounts. This can significantly lower your credit scores, but it’s less draconian than bankruptcy, and your scores can bounce back faster. Even if you decide this is too extreme a step for you, consulting with a credit advisor (as opposed to a credit recovery company) can help you identify strategies to build stronger credit.

Consider a loan for lenders.

Credit unions offer several varieties of these small loans, which are designed to help people establish or rebuild their credit histories. One of the most popular options, the credit union deposits the amount you borrow into an interest-bearing savings account (rather than giving you the money directly). Once you’ve paid off the loan, you’ll have access to the money, plus the interest it generated. It’s a smart savings method, but the real benefit comes when the credit union reports your payments to the national credit bureaus. Before applying for a credit-building loan, ensure that the lender reports payments to all three national credit bureaus. As long as they do and as long as you regularly pay on time, these loans can lead to credit score improvements.

Consider purchasing a secured credit card.

When you open a secured credit card account, you deposit the full amount of your spending limit, usually a few hundred dollars. As you use the card and make regular payments, the lender reports them to the national credit bureaus, where they are included in your credit files and reflected in your FICO® score. Paying on time and avoiding using the card “to the max” promotes improvements in your credit scores.

Pay your bills on time.

There is no better way to improve your credit score.

Avoid high credit utilization rates. Try to keep your usage below 30% on all your accounts to avoid dropping your score.

Among consumers with FICO® credit scores of 501, the average occupancy rate is 113.1%.

Try to establish a solid credit mix. The FICO® credit scoring model tends to favor users with multiple loan accounts and a mix of different loan types, including installment loans such as mortgages or auto loans and revolving credit such as credit cards and some mortgages.

Is 501 a Bad Credit Score – Which credit card can I get with a credit score of 501?

It can be difficult to get approved for a credit card with low credit scores.

The good news is that Credit Karma can help. You can log in to your account to view your approval opportunities for various credit cards. While your Credit Karma approval chances are not a guarantee that you will be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

Secured credit cards

Applying for a secured credit card may be your best option if your credit still needs some work. With a secured card you pay a deposit in advance. This deposit generally determines your credit limit. So, for example, if your security deposit is $300, your credit limit can also be set at $300. This gives the issuer insurance in case you close the account without paying your debt.

Because secured cards pose less of a risk to credit card issuers, they may be more available to someone with bad credit. And a secured card can benefit you as a borrower if the lender reports your on-time payments and other credit activity to all three major credit bureaus.

Unsecured Credit Cards

If you can’t afford a security deposit, you may be able to find an unsecured credit card. The trade-off is that it may come with an annual fee, which is arguably worse than a security deposit because it’s usually non-refundable. You may also face higher interest rates.

Store credit cards

Store credit cards generally encourage you to shop at a particular retailer. This type of card may or may not be secure, so technically it is not a third category. But store credit cards are worth talking about as an option as you build up credit.

Why? Because you may have a better chance of getting approved for a store credit card with bad credit. The potential downside is that these cards often have high-interest rates and you may only be able to use them at a specific store. On the other hand, they can offer rewards and benefits that make sense if you are already shopping at a particular store.

If you’ve explored all of these options and still can’t find a card to approve, you may have other options. Consider asking a trusted family member or friend to add you to their credit card account as an authorized user. But first, familiarize yourself with the pros and cons of an authorized credit card user.

Is 501 a Bad Credit Score – Personal loans with a credit score of 501

It can be difficult to get approved for a personal loan with low credit scores.

Given your current scores, you may not have the luxury of shopping around for the best personal loans with the lowest interest rates. Instead, you may have to settle for a high-interest personal loan, not to mention other costs, such as an initial fee.

This can make a personal loan very unattractive, especially if your intention with the loan is to consolidate a high-interest rate on credit card debt. Your loan APR can be as high, if not higher, than the interest you’re currently paying on your credit cards.

On the other hand, if your goal with a personal loan is to finance a major purchase, ask yourself if it’s something you need right now. If you can wait until after you’ve spent some time building credit, you may qualify for a personal loan with a lower APR and better terms later.

If you need money and find it difficult to find a personal loan that you qualify for, then you can consider a personal loan. While everyone’s situation is unique, you should generally be careful with these short-term loans with high fees and interest rates. They can quickly get into a debt cycle that is even harder to get out of.

Before applying for a personal loan, consider whether you have other options.

Is 501 a Bad Credit Score – Bad credit car loan rates

There is no specific minimum credit score required to qualify for a car loan. However, if you have bad credit, it can be difficult to get approved for a car loan. Even with the best bad credit auto loans, beware of high-interest rates, which can make borrowing money very expensive.

If you have time to build up your credit before applying for a car loan, you can end up getting better rates. But if you don’t have the time to wait, a few strategies can help you get a bad credit car loan.

Consider a co-signer if you have a trusted family member or friend with good credit who is willing to share the responsibility for a car loan with you.

Look for alternative lenders, such as a credit union or online lender.

Ask the dealer if there is a finance department dedicated to working with people with bad credit.

Use purchase financing here, pay here only as a last resort.

If your credit needs some work, it’s especially important to shop around to find the best deal for you. The Auto Loan Calculator can help you estimate your monthly car loan payment and understand how much interest you could pay based on rates, terms, and loan amount.

Is 501 a Bad Credit Score – Mortgage interest for bad credit

The average credit score needed to buy a home can vary, but it can be harder to qualify for a loan if your credit needs work.

The mortgage deals available to you may come with high-interest rates that can cost you a lot of money. It is important to consider the long-term financial implications of an expensive loan, and it may be worth taking some time to build up your credit before applying.

But there are a few types of mortgages to consider if you don’t qualify for a conventional loan. These government-backed loans provided by private lenders include…

- FHA Loans

- VA loans

- USDA Loans

If you qualify for one of these types of loans, you may also be able to make a smaller down payment.

No matter what your credit rating is, it’s important to shop around to understand how competitive rates are in your area.

Learn more about your credit score

Every growth process has to start somewhere and a FICO® Score 501 is a great starting point to improve your credit score. Raising your score in the appropriate range (580-669) can give you access to more credit options, lower interest rates, and lower fees and terms. You can get started by getting your free credit report from Experian and checking your credit score to discover specific issues that are preventing your score from going up. Read more about score ranges and what a good credit score is.

Conclusion – Is 501 a Bad Credit Score

Is 501 a Bad Credit Score? Yes, and having a low credit score, such as a 501 score, can have a significant impact on your financial life. These tips can help you understand how a low credit score affects you and what steps you can take to improve your score.