Do credit cards have routing numbers? A credit card doesn’t have routing numbers because they don’t need them. Routing numbers are only needed when transferring money between savings, investment, or checking accounts. But it has security features like an expiration date plus three security codes on the back of the card.

It’s understandable where the misconception comes from that credit cards have routine numbers. Credit cards have account numbers which are usually 16-digit numbers printed on the front of your credit card or the back. Therefore, a credit card account number serves as both a routing number and an account number in one number.

At the same time, other modern cards do not show numbers on the card itself. They choose to give the customer that information via an app. These credit card account numbers act as a link between the cardholder and the credit card issuer.

Bottom line: no, credit cards don’t have routing numbers. But what they have to tie you to an account and what makes a routing number unique raises some interesting questions. Let’s look at the answers.

Table of Contents

What Is A Routing Number?

A nine-digit number used to identify a bank or financial institution in the United States is called a routing number. This is necessary information when checking out money for online transfers and when processing checks.

Clearinghouses rely on the routing number to accurately process financial transactions. The online banking functionality will also not work if there are no routing numbers.

However, not all financial institutions have a routing number. Only federal and state chartered banks are eligible to maintain an account with a Federal Reserve Bank to which routing numbers are issued.

Routing numbers have been in use for over a century. They were first established by the American Bankers Association in 1910.

Routing numbers play an essential role in setting up a bank transfer. There is no physical currency that moves between banks when such a transfer is made. It is the information that is sent from one bank to another.

Therefore, a transaction must run smoothly to have the correct routing number. Routing numbers are also used on direct deposits of money from employers who pay employees, in addition to being used for income tax refunds by the Internal Revenue Service.

Routing numbers are not always referred to as routing numbers. There are some terms the industry uses for the same nine-digit number.

You will find route numbers called transit routing numbers and even ABA numbers. ABA is an acronym for American Bankers Association, a nod to the fact that it was the ABA that established routing numbers in 1910.

How Do You Find Your Bank Routing Number?

There are several ways that you can find your routing number easily and quickly. Some of these methods are;

- Your Checks: Look in the bottom left corner of all your checks. The nine digits are your routing number. In comparison, the number to the right of your routing number is your bank account number. Be careful not to confuse these numbers as this will cause a delay in your deposit or payment.

- Bank statements: Check your latest bank statements; Several banks often include the ABA routing number as part of the account information. These account statements are sent monthly by the bank via electronic statements without paper or mail.

- Bank websites: Different banks list their routing number on their websites. Keep in mind that some banks have more than one routing number. Instead, some have different routing numbers for Automated Clearing House (ACH) transactions or wire transfers. Therefore, it is essential to understand what type of transactions you are dealing with before obtaining the routing number. You will also notice that these major national banks have different routing numbers for different states.

- Call your bank: If you are unsure of your bank’s routing number, you can contact the bank’s customer service. Then ask the staff to confirm the correct routing number.

- Check ABA Online Lookup Tool: There is a free ABA routing number search tool on the website to check routing numbers from different banks. But you are limited to using this tool to search only two routing numbers per day and up to 10 per month.

- Google It: Enter the name of the financial institution plus the routing number. There is a good chance that the ABA number will appear in the search results.

Difference Between ABA and ACH Routing Number

ACH routing numbers apply to electronic transfers and withdrawals, while ABA routing numbers apply to a paper check. However, some banks today use similar routing numbers for both. But it’s not uncommon to see different ACH and ABA routing numbers for the regional lender.

ABA routing numbers are sometimes referred to as “verification routing numbers” while ACH routing numbers are referred to as “overbooking numbers” or “wire routing numbers.” In cases where only one number is listed, the ACH and ABA routing numbers may be similar. You can always call your bank to confirm this.

Do Credit Cards Have Routing Numbers?

Do credit cards have routing numbers? Credit cards do not have routing numbers. The fact is, credit cards don’t need them either. As we discussed above, routing numbers are only required to transfer money between accounts via wire transfers, checks, etc. That’s not what a credit card is for.

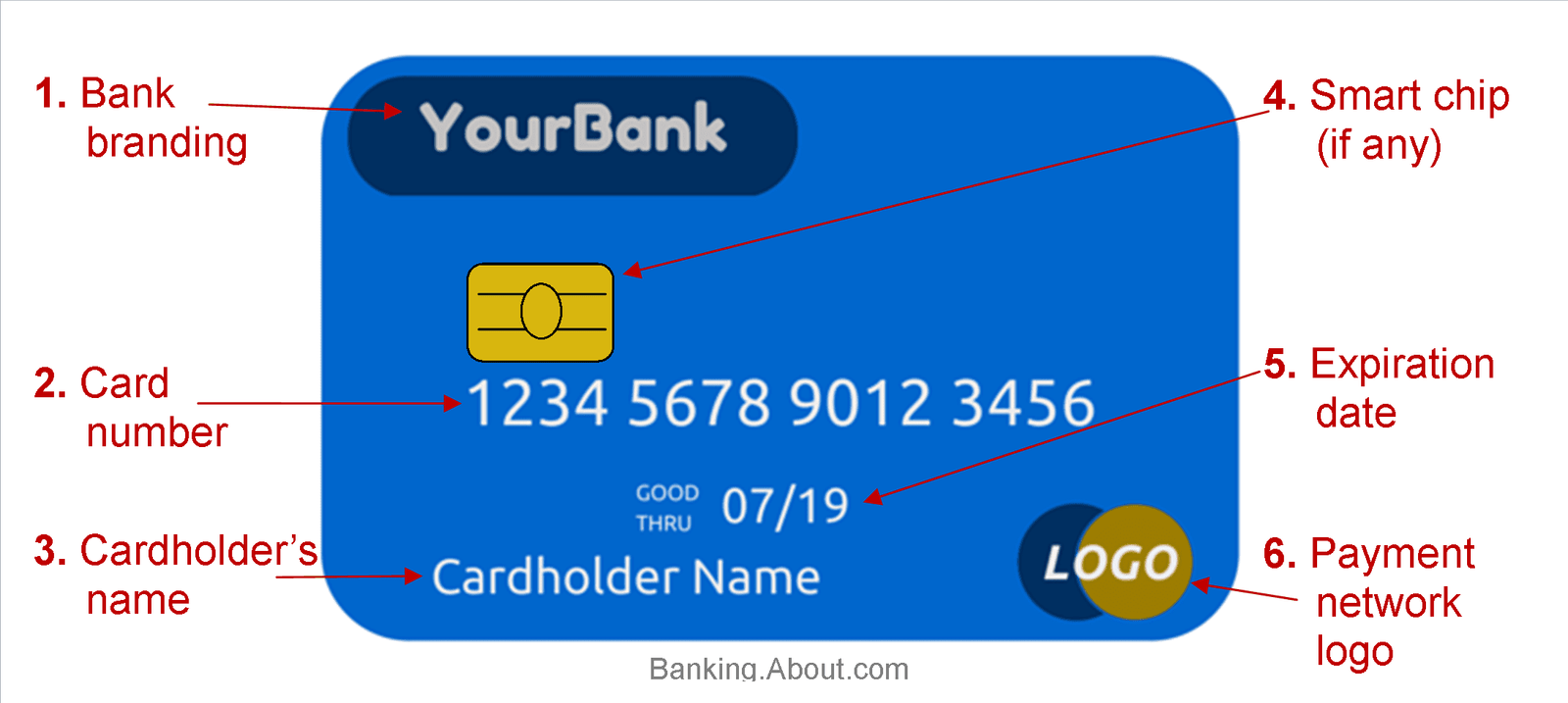

It’s easy to see where the misconception comes from that credit cards have routing numbers. All credit cards have a 16-digit number. They can be on the front or back of the card.

Some modern cards have minimal aesthetics and don’t list numbers on the card itself, opting to provide that information to customers through an app.

What credit cards do have are account numbers. This number acts as a link between the credit card issuer and the cardholder. This information is essential to process payments.

The first digit of the card number indicates the type of card. If the number starts with 3, it is an American Express card. Visa cards start with the number 4, while a Mastercard starts with the number 5. Discover cards start with the number 6.

The next 6 to 8 numbers are what is known as the Publisher Identification Number. They are also known as bank identification numbers. These numbers are used to identify the financial institution that issued the credit card.

The remaining numbers are unique to each cardholder as they are intended to identify the customer’s specific credit account with their financial institution. These numbers are chosen by the card issuer to indicate your account number.

Why Don’t Credit Cards Have A Routing Number?

The purpose of a credit card is not to send electronic transfers or direct deposits. Customer does not spend their own money when using a credit card for a purchase. It is the bank that gives them a certain credit limit that they can use every month.

Each time the card is used for payment, it is the bank that pays the merchant in full. The cardholder does not have to pay directly to the bank. Only when your billing cycle arrives will the bank be obligated to receive payment for the money you have already paid to the merchant on behalf of the customer.

Such a transaction does not require a routing number. Credit card payment settlement mechanisms are completely different from bank transfers and direct deposits. They do not rely on a routing number to process transactions. That’s why credit cards don’t have a routing number.

Will Your Credit Card Help Save The Planet?

Speaking of credit cards, have you ever heard of a credit card that helps you save the planet? The Aspiration Zero Credit Card is a revolutionary new product that helps cardholders achieve carbon neutrality. Not only that, it actively encourages them to reach that milestone.

Aspiration plants a tree every time the credit card is used for a transaction. It also gives customers the option to plant a tree with every purchase.

Support customers’ efforts to become carbon neutral and provide them with an in-app tracking dashboard. Those who achieve zero carbon emissions each month get up to 1% cash back on all their purchases.

Use of credit card numbers

Every credit card has a 16-digit number that contains essential information to process payments. As mentioned above, credit card numbers do not contain routing numbers, although they do contain crucial information that facilitates payment processing. Here is the essential information about card numbers;

The first digit: The first digit of the card number indicates the type of card. If the card number starts with three, it is an American Express card, while Visa cards start with the number four. On the other hand, MasterCard starts with number five while Discover starts with number six.

The next 6-8 digits: The next six to eight numbers are known as Issuer Identification Numbers (IINs) or Bank Identification Numbers (BINs). They are used to identify the financial institution that issued the credit card.

Remaining digits: The remaining digits are unique to each cardholder. Those numbers are intended to identify the customer’s specific credit account with the financial institution. They are selected by the card issuer to indicate your account number.

Difference Between Routing Number and Account Number

The routing number identifies a specific bank while the account number identifies the personal account number. In general, the routing number is the first nine-digit number on your check in the lower left corner. The number is closely followed by the account number, which is unique to you.

Final Thoughts On Do Credit Cards Have Routing Numbers!

Bank routing numbers are not things that some of us regularly think about in our day-to-day banking transactions, although they do serve an important purpose. These nine-digit numbers are very important as they help the bank identify each other, avoid errors and delays and build trust in the banking system. It also ensures that people’s deposits and payments go to the correct accounts.

If you’ve never used your routing number before, it’s a good idea to keep it in a safe and accessible place. You may need it in the future. While the bank’s ABA routing number is public information, your account number and credit card information are not. Therefore, it is recommended not to share them unless it is essential to avoid possible fraud.