Can I get my PPP loan on my cash app and do cash apps accept PPP loans? Yes, Cash App can be used for PPP loans. The application called Cash App is an application that allows users to transfer money from one to another through a mobile phone application (Cash App). As published statistics on their successful journey to March 21, 2021, they were recorded to have registered 36 million active users on the transfer medium.

In all countries (the United States of America and the United Kingdom) that accept the use of Cash App gives loan.

Table of Contents

What is the PPP loan?

In its entirety, PPP translates to ‘The Paycheck Protection Program’. It was born to give small businesses an immediate incentive to keep their employees on the payroll.

They are not repaid loans. The draft says they only ask the recipients to show that they have spent the money well to prevent the recipients from losing jobs or wages.

Does the Cash app accept PPP and SBA loans?

Why not? Yes, the cash app accepts PPP and SBA loans.

Can I Get My PPP Loan On My Cash App 2022?

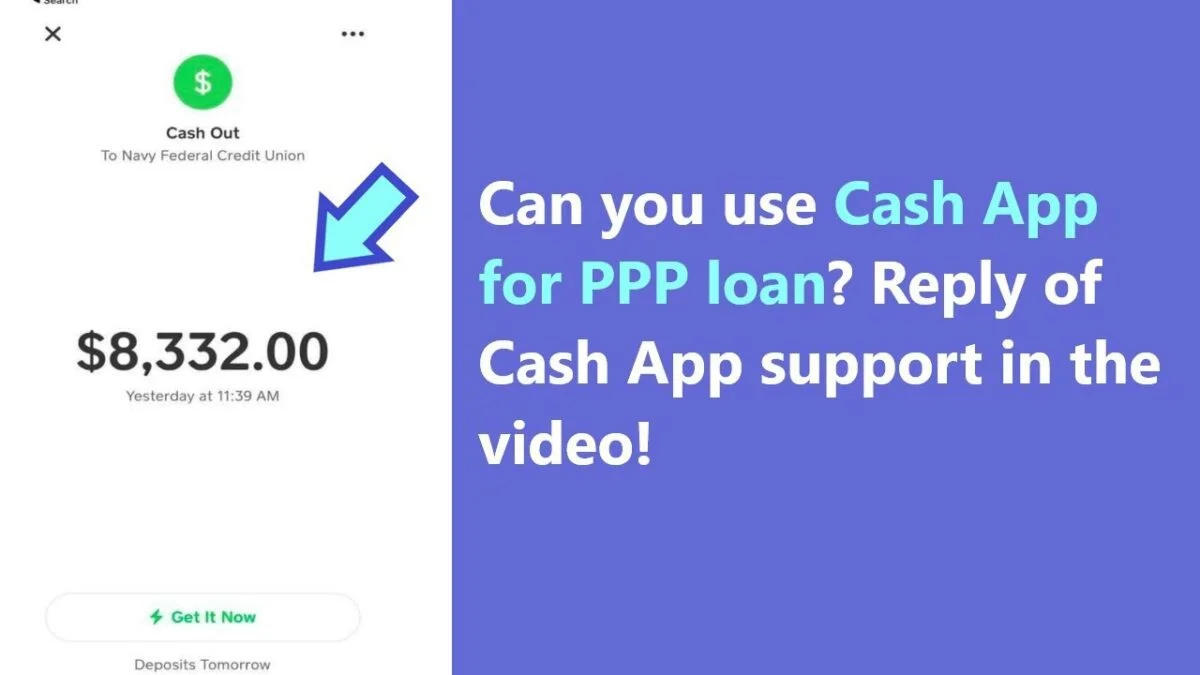

Referring to the Cash App support team in their Twitter post, 👉🏿 “@CashApp, are you taking the PPP loans?”

Answer From Cash App Support “@CashSupport –

You can deposit money from a PPS loan into your Cash App account via direct deposit! Note: Direct deposits cannot exceed $25,000 per day. If it is attempted, it will be returned to the original depositor.”

How to apply for PPP loan forgiveness?

Small business owners can apply for a PPP loan forgiveness once all the proceeds of the loan for which the borrower is requesting forgiveness have been used.

These borrowers can apply for forgiveness at any time up to the maturity date of the loan.

However, if a borrower does not request loan forgiveness within 10 months of the last day of the secured period, payment of the PPP loan cannot be deferred and borrowers must begin paying loans to their lender.

To apply for the PPP Loan Forgiveness Program, the following steps must be taken:

- Determine if your lender participates in direct forgiveness through the SBA;

- Compile a list of your documentation;

- Submit the forgiveness form and documentation to the SBA or your PPS lender;

- Keep an eye on your forgiveness request.

How much money does a PPP loan give?

PPP loans are provided with a maximum of “you could borrow up to $250,000”.

You can be the first PPP borrower to borrow for 2.5 times your average monthly payroll, up to a maximum of $10 million. It means that if your average monthly salary in the past 12 months was, say, $100,000, you could borrow up to $250,000.

You may deposit money from a PPP Loan via direct deposit into your Cash App account.

At which banks can you receive your PPP loan?

If you would like to receive your PPP loan from one of the many major banks in the country, here are some options for you. SunTrust Banks and Branch Banking & Trust recently merged and are both SBA lenders. Trust Financial Corporation is the eighth largest bank in the country and has offices in 15 states. If you are currently a customer of the bank, you can apply for a PPP loan via the online portal.

Key Point Credit Union accepts Paycheck Protection Program loan applications from existing corporate clients. Navy Federal Credit Union is another bank that accepts applications from current corporate clients. Lendio, a marketplace for small business loans, connects applicants with approved lenders. Newtek Small Business Finance is another business development company that accepts PPP loan applications. Kabbage is a fintech platform with direct funding.

Conclusion – Can I Get My PPP Loan On My Cash App 2022

If you’re still wondering if you can get PPP loan on your Cash App in 2022, the answer is Yes, you can use Cash App to receive PPP loan and SBA loan as well. So, go ahead and request for PPP loan using your Cash App now.