Is Shein Safe for Credit Cards in 2023?

Is Shein safe for credit cards? While everyone likes to get a lot, some shady online stores can be too good to be true. There are many reputable sites, but many scam shops will take your money and send you completely different items, or nothing at all.

Watch out for suspiciously low prices from stores you’ve never seen in person. Many websites like Shein leave online customers conflicted about whether it is worth the risk.

is Shein safe for credit cards? Shein is a scam? Between very cheap prices and a wide selection, Shein.com almost seems too good to be true. Can you trust it despite being so affordable?

Table of Contents

What is Shein?

Shein became a household name in recent years as her enticing ads flooded social media platforms around the world. You’ve probably come across an ad from Shein, the company that made its fortune from online campaigns.

Many people find out about Shein through posts on Facebook or Instagram. Shein shows stylish clothing or trendy duvet covers at ridiculously low prices.

There are even times when specific products are nearly identical to branded items, just for a tenth of the price. It gets complicated when you ask if Shein is a real shop.

Shein is primarily a digital retailer, although the company has had success launching a few select brick-and-mortar locations.

Most of these stores are just pop-ups in the larger cities, so if you want to experience all that Shein has to offer, you should probably visit their website or the Shein app.

Is Shein a scam?

Investigating if Shein is a scam gets mixed reviews. Sure, some claim that the Shein website has scammed them out of their money, but the company fulfills countless orders every day from all over the world.

Some red flags make people wonder if Shein is legit or not. For starters, Shein is not BBB accredited, which means they don’t have that extra customer satisfaction support.

Is Shein Safe For Credit Cards?

Is Shein safe for credit cards? Yeah, the answer to your question is that, your credit cards is safe at Shein.

Where does Shein ship from?

Despite these red flags, many people order from the sites. Shein appears to be a safe site in the sense that your payment information and identity will not be stolen.

It also seems to be trusted by users all over the world from South Africa to the UK and from Australia to Canada, suggesting that most people receive the products they order.

While it’s a “legitimate” company that won’t scam you with false promises, ironically, the low cost comes with a price. What is Shein’s game? Is Shein a good website to support?

Why is Shein so cheap?

Shein’s official inventory is quite extensive and they seem to offer everything at a fraction of the cost. Shein is a good website for anyone looking for fashion bargains to grow their wardrobe without breaking the bank.

Shein’s clothes come at a price, though. If you have some time to check out some honest Shein clothing reviews, you will see a lot of complaints about the quality of the clothing.

Many Shein reviews state that the brand’s clothing quickly fades, loses its shape or shows wear and tear. Those who are dissatisfied or seeking a return or exchange run into another notorious problem of the company.

Shein customer service is known for being unresponsive, making it difficult to get help when you need it.

Is Shein ethical?

The quality of Shein products or inferior products is not the only thing Shein is concerned about.

There is a reason that products made in China tend to cost less than products produced in the West. The labor laws in China are much more lenient than, say, the US or Canada, making it easier for a company to exploit its employees.

Because they can legally pay their workers so little and force them to work long hours without breaks, their end product is cheaper.

Note that this is true for many companies, and we don’t particularly emphasize Shein; in fact, the site emphasizes that it is constantly working to care for the health and well-being of its employees. However, is Shein safe for your back-end staff?

Many large companies import products from Eastern companies simply because it is very cheap to keep their prices low (and their profits high).

If you want to put ethical fashion first, Shein is not your shop. There are numerous ethical alternatives to popular companies that are worth checking out.

Is Shein reliable and safe?

Apart from everything else, it is safe to order from Shein. You don’t have to worry about getting caught up in some fancy phishing scam. The only thing that you risk by ordering from the official Shein website is that you may be disappointed in the future.

How to order from Shein: tips that work

When browsing sites that offer lower quality items at low prices, it always pays to think ahead. Is Shein a legit website? Here are some tips to keep in mind to avoid making a purchase you may regret later.

Check size charts

Sizes are not consistent between Shein garments. Be sure to check the size charts in each listing and Shein reviews as some suggest that Shein dresses vary in size between different items.

Pay close attention to the section your item is in as this will affect the cut of the clothing. You have to buy the part that fits your body whether you are plus size, petite, or just medium like us.

Avoid everyday basics

Shein is a great place to find statement outfits or experimental pieces to try on, but not necessarily pieces you’ll wear every day. Your clothes are usually not made to last.

If you are looking for sustainability, you better invest. For example, many reviews of Shein swimwear complain about a lack of support and elasticity after several baths.

Read All Reviews

Customer reviews provide honest feedback that you should consider. Don’t just look at the five stars though: these can be fake or slick, so always look at the big picture.

Always make sure to check ratings for your location as a New Zealand rating may not apply to those shopping through Shein Canada.

And be aware of the return policy and shipping times for a particular item before adding it to the cart.

IS SHEIN SAFE FOR CREDIT CARDS FAQ

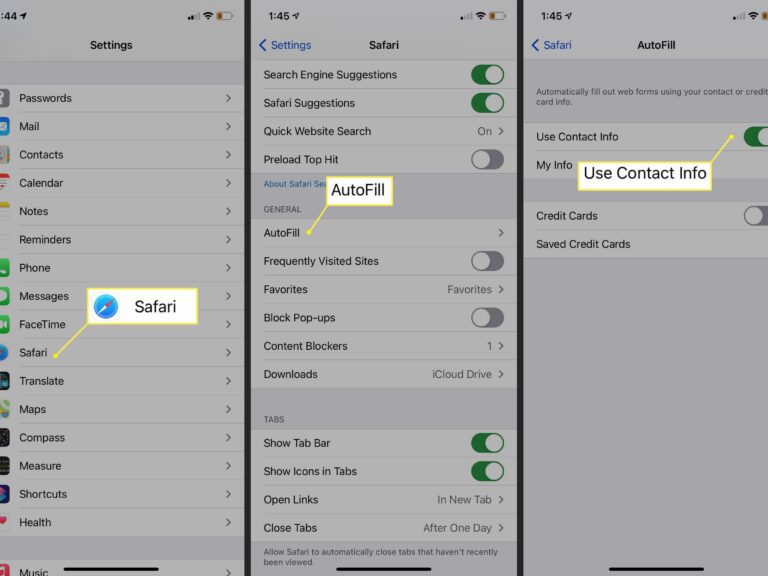

Does Shein Take Your Credit Card Information?

Please note that SHEIN does not collect your credit/debit card number or personal information when you make payment.

Does Shein steal credit card information?

Fortunately, SHEIN says it does not normally store payment card information on its systems, and there is no evidence that customers’ credit card information could have been stolen.

Can Shein be trusted?

So to answer your questions in a nutshell: yes, it is a reliable website where you can buy. They are based abroad so expect a shipping delay but I was lucky and received my items within 2 weeks.

Can I entrust my credit card to Shein?

It is safe to order from Shein. You don’t have to worry about it being a well-designed phishing scam. By 2021, Shein appears to be able to securely share credit or debit card information.

Is Shein stealing account information?

Women’s online fashion retailer SHEIN suffered a major security breach that exposed the personal information and passwords of more than six million customers. … He added that between June and beginning

Is it safe to use a credit card with SHEIN?

It is safe to order from Shein. You don’t have to worry about it being a well-designed phishing scam. By 2021, Shein appears to be able to securely share credit or debit card information.

Can SHEIN be trusted?

So to answer your questions in a nutshell: yes, it is a reliable website where you can buy. They are based abroad so expect a shipping delay but I was lucky and received my items within 2 weeks. 27

Does SHEIN steal account information?

Women’s online fashion retailer SHEIN suffered a major security breach that exposed the personal information and passwords of more than six million customers. … He added that between June and beginning

Will SHEIN steal your data in 2023?

Is Shein Legitimate? Yes, this is a real company… and a big one. It is not a phishing scam trying to steal your credit card information. The items you order correspond to the photos on the website. twenty

Is it safe to order from Shein?

It is safe to order from Shein. You don’t have to worry about it being an elaborate phishing scam. As of 2021, Shein appears safe to share debit or credit card information.

Can you trust Shein?

So to answer your questions in a nutshell: yes, it is a reliable website where you can buy. They are based abroad so expect a shipping delay but I was lucky and received my items within 2 weeks.

Why is Shein bad?

Shein has traditionally used unethical practices such as child labor and sweatshops. Shein is one of the fastest growing online fast-fashion retailers. … Industry is incredibly harmful to the environment, with fashion being the second most polluting industry in the world.

Is it safe to order Shein from 2023?

Yes, Shein is reliable. This answer should take many factors into account, but in general, they are reliable. Once you are fully aware of their processing and shipping times and return policies, you should have no problems.

Is Shein Safe For Credit Cards – Is Shein A Good Website?

Is Shein Safe For Credit Cards? is Shein a scam? If you’re looking for cheap clothes, Shein is a great place to shop if you’re not concerned about quality. Shein is a safe place to shop, but try not to forget about sustainable alternatives that source their products ethically. But Shein reviews don’t lie; For trendy favorites that last, you may want to take your business elsewhere.